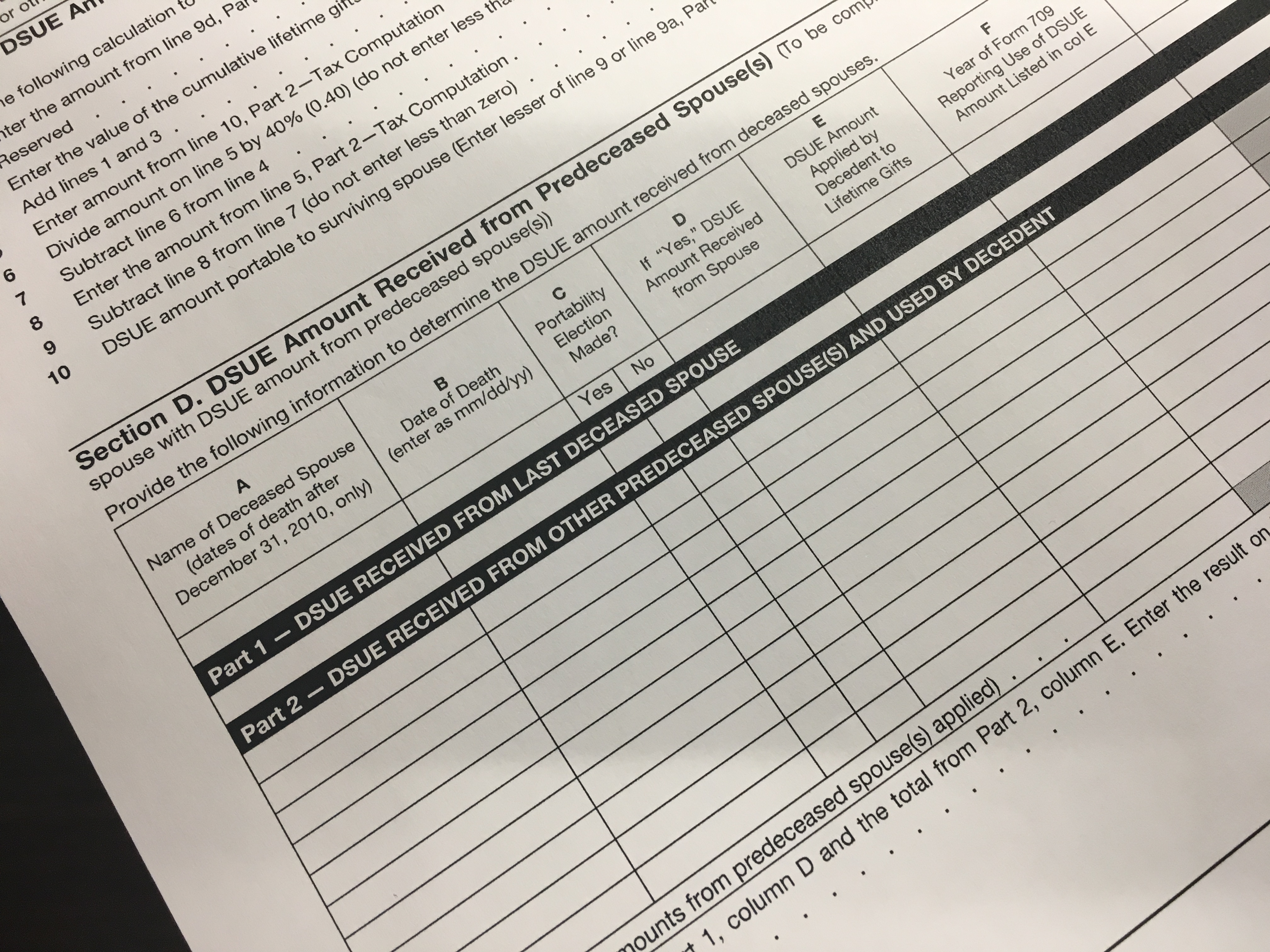

As enacted by the Tax Relief, Unemployment Insurance Reauthorization, and Job Creation Act of 2010 and made a permanent part of the Internal Revenue Code by the American Taxpayer Relief Act of 2012, “Portability” allows a surviving spouse to utilize the unused portion of the Federal Estate tax exemption of their deceased spouse (the Deceased Spouse Unused Exemption amount or DSUE) and add it to their own estate and gift tax exemption. One potential tax issue created by portability was recently explored for the first time in the case of Estate of Minnie Lynn Sower v. Commissioner, 149 T.C. No. 11 (September 11, 2017).

Mrs. Sower’s Husband had died in 2012. His estate validly elected portability on a timely filed Form 706 (Estate Tax Return). When Mrs. Sower died in 2013, her Estate utilized her Husband’s DSUE in calculating the estate tax due. After her return was filed, the IRS chose to examine Mr. Sower’s Estate Tax Return to determine whether the correct DSUE was claimed on his Wife’s Estate Tax Return. The IRS made an adjustment to Mr. Sower’s return, which, in turn, modified the DSUE available on Mrs. Sower’s return. The IRS then determined, as a result of the adjustment to the DSUE that there was a deficiency on Mrs. Sower’s return. The representative of her estate argued that the IRS could not examine her Husband’s Estate tax return based on three arguments; (i) the statute of limitations had run, (ii) the fact that the examination would amount to a second examination prohibited by IRC § 7065 and (iii) the Husband’s estate had been issued a “closing letter” accepting the return as filed, which they argued was the same as a closing agreement between the parties.

The court ultimately agreed with the IRS that sufficient authority existed to examine the predeceased Husband’s Estate Tax Return under §2010(c)(5)(B) and Reg. §20.2010-2(d). In those provisions, the IRS is specifically granted authority to review the return of a predeceased spouse for the purposes of determining the proper DSUE to be used on the second spouse’s death, regardless of statute of limitations. In addition to the specific grants of authority, the court noted that the IRS has broad powers under §7602. Further, the court denied the argument presented by the Wife’s Estate that the examination of the Husband’s return amounted to a second examination. The court held that no new information was obtained from the Husband’s return and that IRC § 7065 objections can only be raised by the party claiming to be examined for the second time.

Most importantly, practitioners should note that the court held that the examination of the Husband’s 706 was proper because the estate tax closing letter did not amount to a closing letter, as defined in §7121, which states there must be an agreement between the IRS and the decedent’s Estate.

This case should serve as a reminder of the importance of maintaining the records utilized in preparing an estate tax return of the first to die spouse, regardless of the number of years that have passed.

For more information on portability or any other tax issues that might concern you, contact Katz Chwat, PC to set up an appointment.

Posted in: Tax